Here’s how I think life is like.

When we were all young and students, we didn’t have to worry so much about money. We got some allowances every now and then which paid for whatever little things we needed to buy and we work part-time jobs during our holidays to earn a little bit of extra money if we want to spend a little more on something.

For big ticket items, some of us lucky ones get to beg and pester our parents to buy them for us. Like a new XBOX, a new mobile phone or the likes.

You don’t really know in detail where the money comes from and how much of it is there but it often seems enough so that’s all that matters.

You don’t really know in detail where the money comes from and how much of it is there but it often seems enough so that’s all that matters. Sooner or later though, things start to change.

Sooner or later though, things start to change.That’s just somehow the way modern society is like. Most of us can’t possibly afford to buy a house or even a car in cash. Think about how much we earn and think about how much a decent apartment costs. That’s like RM300,000-RM400,000.

How many years do you have to work and save before you have that much money in cash. For many of us it’s tens and tens of years… so we all borrow and we live the rest of our lives working off the debt we accumulate. That’s why banks do so well because they sell products that society needs: Financing. Without financing most of us won’t be able to buy the cars or the houses we live in for most of our lives.

How many years do you have to work and save before you have that much money in cash. For many of us it’s tens and tens of years… so we all borrow and we live the rest of our lives working off the debt we accumulate. That’s why banks do so well because they sell products that society needs: Financing. Without financing most of us won’t be able to buy the cars or the houses we live in for most of our lives. Then you’ll have to think about how much it costs to raise a family, pay for your kids education and then sooner or later it’ll probably dawn on you that…. While you’re spending so much time and money already trying to survive while you have a job. What happens when you retire?

Then you’ll have to think about how much it costs to raise a family, pay for your kids education and then sooner or later it’ll probably dawn on you that…. While you’re spending so much time and money already trying to survive while you have a job. What happens when you retire?I’ve actually seen quite a number of my friends already sign up for some of these plans where they pay a small amount each month for some peace of mind. So that they know they have some money saved for them when they retire. The question of course is… how much money do you really need?

I mean… you don’t want to be saving every single cent your whole life. You want to be able to indulge every once in a while right?

So the answer to that I guess is a tool Prudential has on their website called the Prudential Retirement Calculator.

Then you put in a scale of how comfortably a lifestyle you want to live when you retire.

For me I put it all the way to the end at “INDULGENT”. Simply because… hey… if I’ve come to the end of my life after spending the past 40 years working, I’d really like to indulge in whatever money I earned in the past 4 decades.

You can choose to modify some of the categories.

You can choose to modify some of the categories.

Like for me I decided that by the time I was 65, I would probably own my own home free of my mortgage. So I won’t have to pay rent or a mortgage. So housing would be 0.

Travel & Entertainment is fairly low for me because I don’t think I’d like to be travelling much at 65. Probably would like to stay put at one place.

But one thing I’d really spend a lot on though is… FOOD!!!!

So I put some RM2,000 a month just on food for the household.

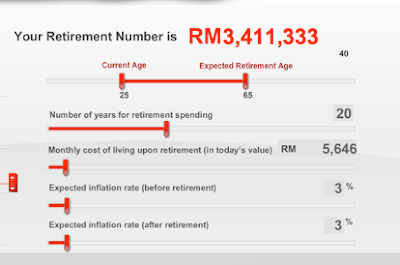

Then you add in some things like the inflation rate you want to take into account and it finally lands you in this last page where it tells you what your number is. As in how much money you need at retirement.

Then you add in some things like the inflation rate you want to take into account and it finally lands you in this last page where it tells you what your number is. As in how much money you need at retirement. And whether your earnings right now will give you enough money to get there or not.

And whether your earnings right now will give you enough money to get there or not.This screenshot is just for illustration purposes because…. I shy to show people how much I earn and all. I’ll avoid that.

But based on the variables I put in for my lifestyle in the slide bright before this. My number actually is….

“Well if you put it that way…”

If you’re free there’s also the “What’s Adam’s Number” challenge going on where you figure out Adam’s retirement number and if you guess it right you’ll stand a chance to win a share of RM200,000 worth of prizes. The challenge will run for 4 weeks from 2nd December 2009 and they’ll release new clues each week to help the players get closer to guessing Adam’s number.

So it’s like in Week 1 you get some clues, then you adjust the values into the calculator and you get a bit closer to his number.

Timothy Tiah – Co-Founder of Colony, Kuala Lumpur Co-Working Space

Timothy Tiah – Co-Founder of Colony, Kuala Lumpur Co-Working Space